Why You Need a Hurricane Supplement to the Seller’s Property Disclosure Form

In 2024 Hurricane Helene’s storm surge damaged tens of thousands of homes on the west coast of Florida. Hurricane Milton’s winds came two weeks later causing more damage. Entire neighborhoods were still undergoing construction repairs and replacements six months later. As many of these homes come on the market for sale, legal questions are being asked. How much information must a seller disclose about storm damage to the buyer? What questions should a buyer ask about storm damage before signing a contract for purchase?

In the olden days before 1985, the seller was not required to make disclosures. In that year the law in Florida changed to require this disclosure: “Where the seller of a home knows of facts materially affecting the value of the property which are not readily observable and are not known to the buyer, the seller is under a duty to disclose them to the buyer.” Johnson v. Davis, 480 So.2d 625 (Fla. 1985). And the inclusion of an “as is” clause in a contract does not waive the duty to disclose. Solorzano v. First Union Mortg. Corp., 896 So.2d 847 (Fla. 4th DCA 2005).

In an opinion issued on February 14, 2025, the sellers of an alleged flood-prone home in St. Petersburg attempted to defend the sufficiency of their disclosures. The parties executed an “as is” contract for sale, and the sellers filled out a Seller’s Disclosure form that stated the property had “slight” water damage. After the closing, the buyer sued for breach of contract alleging failure to disclose the flood history of that property. The trial court entered summary judgment in favor of the sellers, but the appellate court sent the case back to the trial court for further litigation as to whether the disclosure was sufficient. Smith v. Lynch, 2025 Fla. App. LEXIS 1169 (Fla. 2nd DCA 2/14/2025).

As these cases show, full disclosure of the effects of flooding on residential property being sold in Florida is required by law. That being the case, there are thousands of homes on the west coast of Florida that will, at some point in time, prior to their sale, require detailed disclosures regarding the effects of flooding. This suggests the need for a form to use as a starting point for making such disclosures prior to sale.

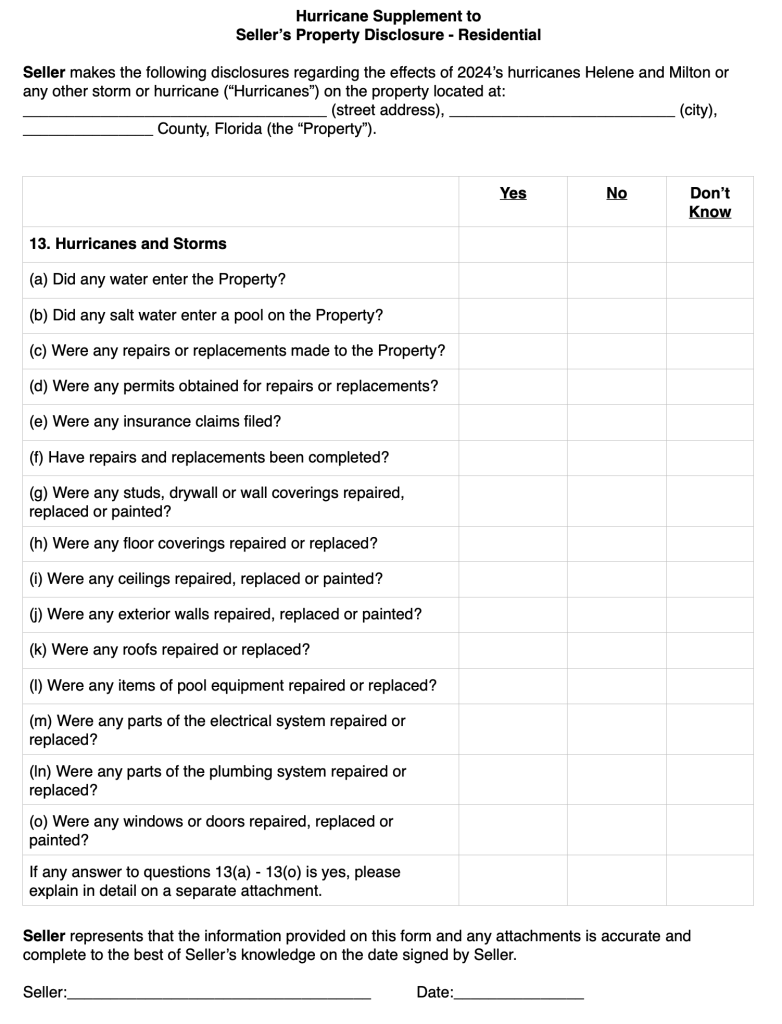

The Florida Realtors has, for years, promulgated the Seller’s Property Disclosure – Residential form for use by Realtors when taking a listing. While it includes questions regarding flooding, it apparently does not ask sufficient questions to satisfy the courts. Therefore, the addition of a Hurricane Supplement to the Seller’s Property Disclosure form may help to accomplish this purpose. A sample form is set forth below as a starting point.

The next hurricane season will be here soon. We can hope that it will render less disaster to our homes than the last one. In the meantime, sellers can help buyers of their homes know what they have done to repair and replace the damage done so far by making detailed disclosure of information. The more, the better.